Buy Sell Indicator Software

Elder. com Education for Intelligent Traders. October 2. 5, 2. 01. In my September letter I showed you the chart of my favorite forward looking indicator, the New High New Low Index. Its best intermediate term term buy signal is called Spike Bounce. That signal occurs several times each year and it can be weak, medium or strong. Buy Sell Indicator Software' title='Buy Sell Indicator Software' />Applied Materials, Inc. NASDAQAMAT is at an overbought level with an RSI14 at 83. The Relative Strength Index RSI is one of the most popular technical. The message in Spike. Trade on August 2. The projected target for such a move is between 6. S P points, measured from the pre signal days close. Adding that to 2. S P close on Monday gives us a target range of 2. My September letter to you showed why the rally had longer to run. It overshot its upper target, reaching 2. Todays action is extinguishing this Spike Bounce signal. Whats next NH NL delivers precise buy signals, but is rather vague on its sell messages. I am working on a new indicator for calling intermediate tops, but that is a work in progress, nor yet ready for prime time. Once the Spike Bounce gets switched off, a trader has a choice. He or she may take profits on most longs and sit back, waiting for the next Spike Bounce to emerge or rely on other time tested indicators to identify shorting candidates. To illustrate, heres a short I added to my existing positions today Click here to enlarge this chart only when youre onlineClick here to read more. Education. Master Class with Dr Alexander Elder. Install Micro Xp From Usb Drive. Thursday, November 2, 8 0. Caribbean November 1. Stocks Software Bundles Find The Right Bundle For You. And Save Up To 40. Auto Fibonacci Phenomenon is LIKE YOU HAVE A FRIEND PROFESSIONAL TRADER, who knows EXACTLY where the price will go and tells you Buy Now. Traders Camp. The 6. September 3. 0Only 2. About seven years ago, the Japanese government apparently decided to buy up the Japanese stock market. Im not kidding.  Camp. Master trading psychology, market analysis, trading systems, and risk management. Work exclusively with Dr. Elder. As a bonus, once you register, youll receive immediate complimentary access to Dr Elder monthly webinars and weekly stock scans. Intensive class in Holland, January 1. Buy Sell Indicator Software' title='Buy Sell Indicator Software' />

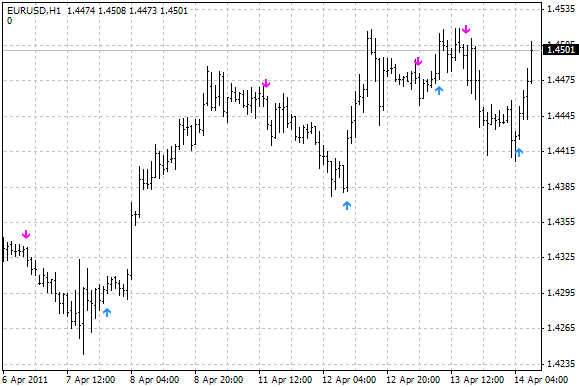

Camp. Master trading psychology, market analysis, trading systems, and risk management. Work exclusively with Dr. Elder. As a bonus, once you register, youll receive immediate complimentary access to Dr Elder monthly webinars and weekly stock scans. Intensive class in Holland, January 1. Buy Sell Indicator Software' title='Buy Sell Indicator Software' />Stock Market research, stock data, charting software and online market web tools. Get ready for the new challenges and opportunities of the new year. Well review psychological rules and technical methods that are working well and apply them to the current markets. Well combine the essentials of the old and the new to hit the road running in 2. Click HERE for a complete description. Click here to read more. Special. Elder disk for Think or Swim version 2. Announcing the new key addition to this Elder disk Force Index with ATR Channels. This is one of the very best tools for identifying reversal zones in stocks, indexes, and futures. Some indicators work best at market bottoms, others are more helpful for catching tops. What makes Force Index with ATR Channels unique is that it works equally well with both. Dr Elder uses it for his weekend scans, looking for the best trading candidates in the coming week. Cost only 2. 29. To read the complete description and to order please click HERE. Click here to read more. An Accurate Buy And Sell Indicator. George Lane developed stochastics, an indicator that measures the relationship between an issues closing price and its price range over a predetermined period of time. Fourteen is the mathematical number used in the time model, and it can, depending on the technicians goal, represent days, weeks or months. The chartist may want to examine an entire sector. For a long term view of a sector, the chartist would start by looking at 1. For more insight on chart reading, see Charting Your Way To Better Returns. Price Action. The premise of stochastics holds that a stocks closing price tends to trade at the high end of the days price action. Price action is the prices at which a stock traded throughout the daily session. The stock may have opened at 1. The price action of this example is between 9. If the issue, however, is currently in a downtrend cycle, the closing prices will tend to close at or near the low of the trading session. Jack D. Schwager, the CEO of Wizard Trading and author of some the best books written on technical analysis, uses the term normalized to describe stochastic oscillators that have predetermined boundaries both on the high and low sides. An example of such an oscillator is the relative strength index RSI which has a range of 0 1. Whether your looking at a sector or an individual issue, it can be very beneficial to use stochastics and the RSI in conjunction with each other. For more, see Ride The RSI Rollercoaster and Exploring Oscillators and Indicators RSI. Formula. Stochastics is measured with the K line and the D line, and it is the D line that we follow closely, for it will indicate any major signals in the chart. Mathematically, the K line looks like this K 1. C L5closeH5 L5C the most recent closing price. L5 the low of the five previous trading sessions. Turkish Gambit Movie. H5 the highest price traded during the same 5 day period. The formula for the more important D line looks like this We show you these formulas for interests sake only. Todays charting software does all the calculations, making the whole technical analysis process so much easier and thus more exciting for the average investor. For the purpose of realizing when a stock has moved into an overbought or oversold position, stochastics is the favored technical indicator as it is easy to perceive and has a high degree of accuracy. Reading the Chart. The K line is the fastest and the D line is the slower of the two lines. The investor needs to watch as the D line and the price of the issue begin to change and move into either the overbought over the 8. The investor needs to consider selling the stock when the indicator moves above the 8. Conversely, the investor needs to consider buying an issue that is below the 2. Over the years many have written articles exploring the tweaking of this indicator, but new investors should concentrate on the basics of stochastics. In the above chart of e. Bay, a number of clear buying opportunities presented themselves over the spring and summer months of 2. There are also a number of sell indicators that would have drawn the attention of short term traders. The strong buy signal in early April would have given both investors and traders a great 1. The current run in the stock started with a strong buy signal just two weeks ago. Although the buy signal appears to have been a false start, it has confirmed that, even in these tough market conditions for the Internet stocks, more new money is coming into e. Bay. Conclusion Stochastics is a favorite indicator of some technicians because of the accuracy of its findings. It is easily perceived both by seasoned veterans and new technicians, and it tends to help all investors make good entry and exit decisions on their holdings. For more insight, read Exploring Oscillators and Indicators Stochastic Oscillator.